2021-05-05 revised 2025-08-05

Charles Cunningham

ReMeLife is a membership organization. A key objective of ReMeLife is that its members should share in the capital value created by its various operations. To this end, ReMeLife is proposing that its operations will be monetised using a blockchain based utility token, the ReMe. ReMe will be expressed on ReMeLife’s own side blockchain as well as on the Ethereum public blockchain and possibly other public blockchains such as the Binance Smart Chain or Polkadot parachains. The tokenized environment that ReMeLife is creating is called the ReMeLife Token Ecosystem (RTE).

ReMe is an ERC20 compliant token that will be freely tradeable on third party exchanges as a utility token. ReMe is the fuel that powers the ReMeLife ecosystem.

ReMe can be earned by ReMeLife members who can spend it in the ReMeLife Marketplace or sell it via third party public exchanges.

ReMe will also be used by third parties such as businesses to purchase access to the ReMeLife ecosystem as well as purchasing digital goods and services provided by and through the ReMeLife ecosystem. It is intended that all such purchases will be paid for in ReMe. The services provided by the ReMeLife system include advertising on the ReMeLife Marketplace and access to member data for research purposes. Service providers to the ReMeLife system will be paid in ReMe, and like all other holders of ReMe, they will be able to sell ReMe for either cryptocurrency or fiat on third party exchanges.

All ReMe transactions carried out in the ReMeLife system will be transacted on ReMeLife’s own side blockchain, where transaction charges will be denominated in, and payable in, ReMe.

The ReMe is a fixed supply digital asset. As the ReMeLife ecosystem grows, the demand to purchase access to the ecosystem and to purchase the digital goods and services provided by the ecosystem will also grow and since these purchases must be paid for in ReMe the demand for ReMe will increase. Since the supply of ReMe is fixed and limited, this increasing demand for ReMe will drive a healthy increase in the value of ReMe.

ReMeLife members will not earn ReMe directly but will earn ReMeLife Care Action Points for each Care Action that a member performs in the ReMeLife ecosystem, and as a reward for their other activities such as referring new members who join the ReMeLife scheme.

There will be an unlimited supply of ReMeLife Care Action Points since they will be created at the time that they are earned.

ReMeLife Care Action Points will not be transferable by members. To be usable, ReMeLife Care Action Points must be converted into ReMe. This conversion will be automatic and will happen every day at the same time.

Every Care Action triggers a “send” transaction whereby a number of ReMeLife Care Action Points are created by aTreasury smart contract and deposited into the member's account.

When a person or business becomes a ReMeLife Member, they immediately receive a ReMeLife Wallet and access to the ReMeLife Referral Program interface (RRP). The RRP will show them that they have immediately earned ReMe Care Action Points for having joined, and illustrate that if they invite family Members, friends and ideally their whole network to join as ReMeLife Members, then they will earn more ReMe Care Action Points.

This is at the heart of the viral tokenomics model, such that when any of their network, down to three levels, invites their network to join, then they also receive tokens as well as their new network joiners.

Furthermore, all parties will also receive tokens when anyone in their network makes a purchase of a product or service from the ReMeLife Market. There is therefore ample incentive to be an active participant in the ReMeLife ecosystem.

At the genesis of the ReMeLife scheme, the Treasury will be allocated an amount of ReMe that is reserved for the benefit of members; this is the Treasury Members Reserve (TMR).

At the start of the daily conversion process, a small fraction of the reserved ReMe will be allocated for that day's conversion.

The number of ReMeLife Care Action Points earned by members on that day will be totaled up and will be divided by the allocated daily amount of ReMe to give a conversion rate of ReMeLife Care Action Points to ReMe.

This conversion rate will be used to calculate the amount of ReMe to transfer into each member's account from the Treasury account. When the ReMe is transferred the member’s points balance will have the number of points being converted to ReMe deducted from it.

A suitable daily allocation by the Treasury of ReMe for conversion would be 1/2000 (0.05% daily) of the current TMR, or TMR/2000.

This fraction should be fixed and applied on a reducing balance basis and results in c. 16.7% of the TMR being transferred to members each year.

The TMR can be supplemented by donations of ReMe from other accounts but ReMe can only be transferred out of the TMR by the points conversion process. Transaction charges collected on the ReMeChain will be deposited into the TMR.

Points will not be transferable, only ReMe may be transferred between accounts.

To improve usability and reduce transaction charges most transactions involving ReMe will be performed on the ReMeChain, this includes the points conversion process.

ReMeLife members only need to transfer their ReMe balance to the Ethereum or other public blockchain when they want to transact with an account that is outside of the scheme such as an exchange or non-member.

Balances can be moved to and from the live blockchain and the ReMeLife ecosystem. These transactions will incur Eth gas charges which the member will need to pay.

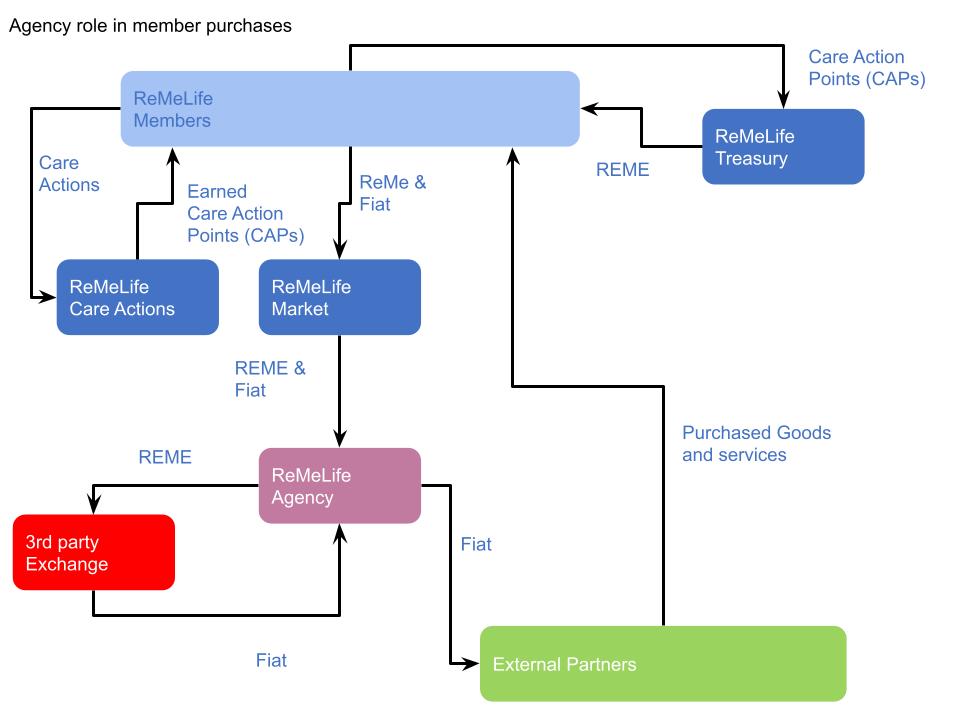

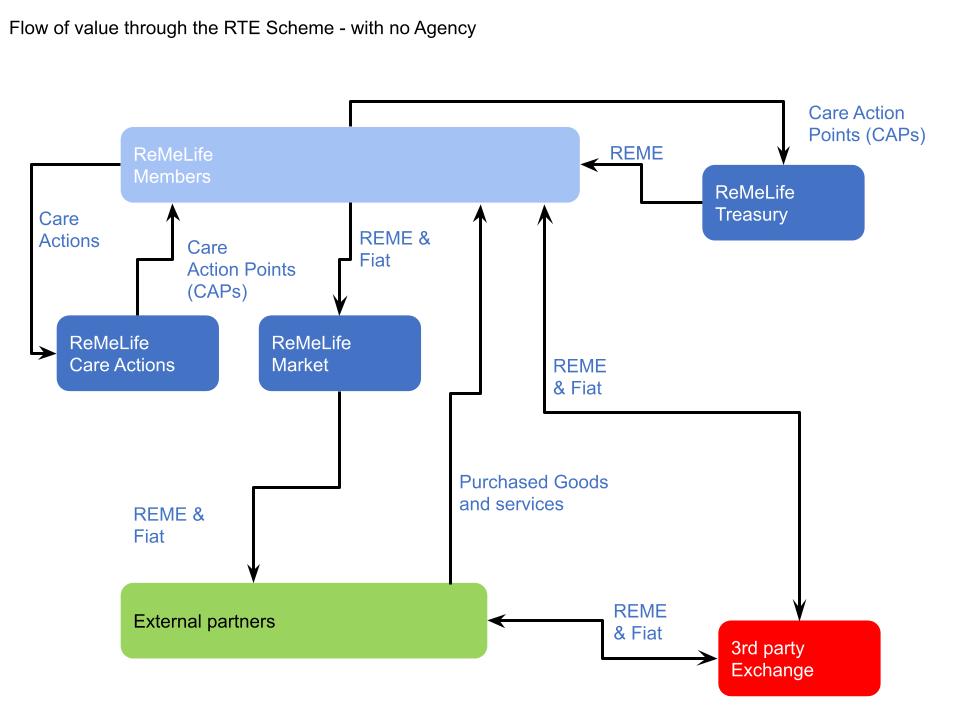

The following diagram shows the normal flow of value through the RTE. ReMeLife members will earn ReMe Care Action Points and these will be converted into ReMe by the Treasury using an automatic process that will invoke a smart contract to perform the conversion.

Members will be able to spend their ReMe in the online ReMeLife Marketplace. This market is a venue for third party suppliers of goods and services.

Purchases are denominated in a mixture of fiat and ReMe. The scheme manages the payment process allowing for the integration of ReMe and fiat into a single payment.

|

|---|

| Transactions using ReMe incur gas charges payable in ReMe. These charges are collected by the Treasury and added to the TMR. |

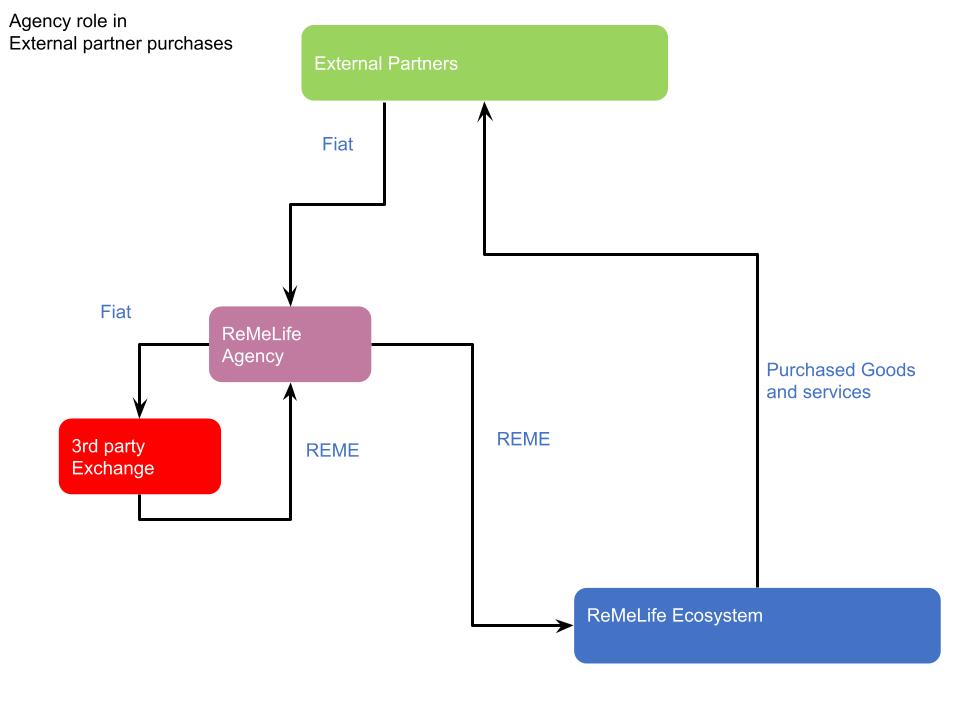

ReMe earned by external partners may be sold for fiat on third party exchanges. External partners may however choose to purchase advertising and other service from the scheme. These transactions will be denominated in ReMe. This may require the external partners to purchase additional ReMe from third party exchanges.

Requiring businesses to interact with the ReMeLife ecosystem in a cryptocurrency, ReMe, will in the early days of the scheme be a barrier to their participation. To overcome this problem a service called the ReMeLife Agency will be established and operated by the ReMeLife Foundation.

The agency will eliminate the need for external partners to transact in ReMe. External partner interactions with the scheme will be optionally conducted via the Agency. The Agency will automatically convert between fiat and ReMe. The following diagrams show two main transaction flows, the first for processing member purchases through the ReMeLife Market and the second showing partner purchases of ReMeLife services.

Discount Model

Items purchased using ReMe as either part or full payment may be sold at a discount relative to their fiat currency prices. Where the vendor chooses to use the discount model, ReMe paid to secure the discount will be retained and burnt by the Treasury.

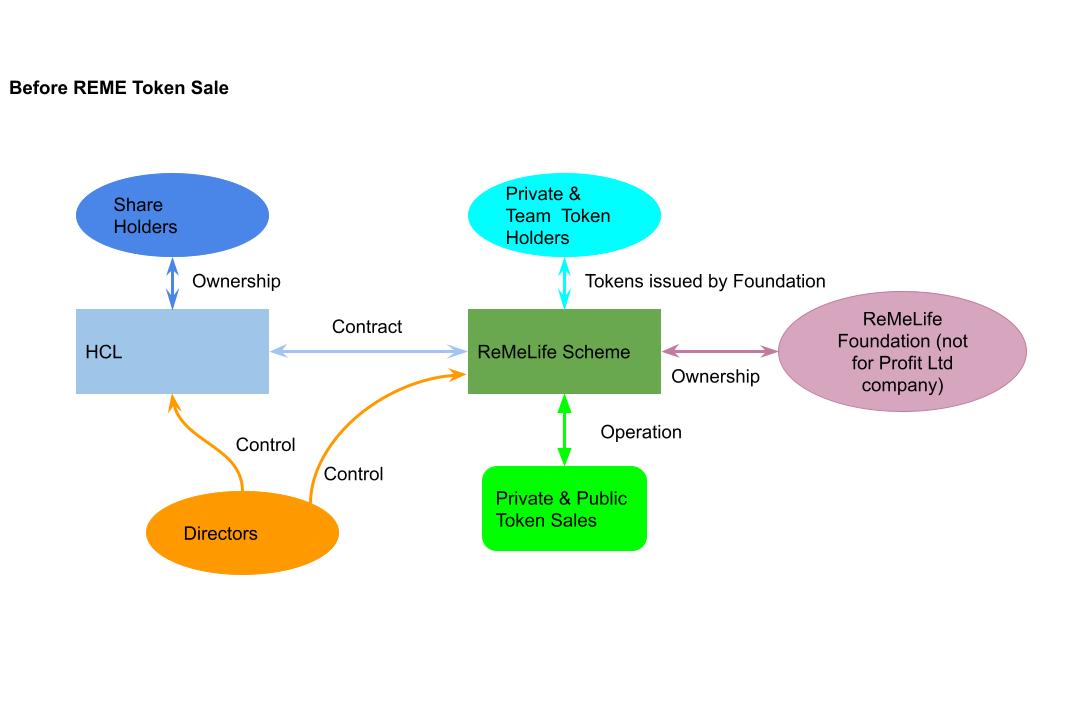

The ReMeLife scheme will be operated by a not-for-profit organization called the ReMeLife Foundation. This foundation will control the ReMeLife Treasury and ReMeLife Agency. Profits earned by the foundation will be used to purchase ReMe from 3rd party exchanges. This purchased ReMe will be burnt to help maintain the value of the remaining ReMe.

It is proposed that 600,000,000 ReMe tokens will be created as a fixed supply.

The proposed ReMe token allocations are:

- 1/3 for the benefit of the membership and will be held in the Treasury Members Reserve (TMR)

- 1/3 for the ReMeLife foundation to maintain and operate the RTE. These funds will form the Treasury Strategic Reserve (TSR)

- 1/3 for private and public sales, existing investors and team members to provide capital and payment for the development of the ReMeLife Token Ecosystem

Health-Connected Ltd (HCL) is at the moment developing the ReMeLife Token Ecosystem. Funding is provided by early-stage investors and profits from HCL’s trading activities. These resources are insufficient to take the scheme forward. It is proposed that the development of the scheme should be funded from the proceeds of a number of sales of the ReMe token including a private sale and a public sale.

The token sales will be performed by and for the benefit of the ReMeLife Foundation. The ReMeLife Foundation will have a contract in place with HCL to pay HCL for its services and IP with respect to the development and operation of the scheme

The ReMeLife ecosystem is based on an ERC20 token, the ReMe, and a smart contract based points scheme, ReMeLife Care Action Points (RCPs).

ReMeLife Care Action Points are paid to ReMeLife members for each interaction that a member has with the ReMeLife Token Ecosystem scheme and also as a reward for other activities such as referring new members who join the ReMeLife scheme.

ReMeLife Care Action Points will be exchanged by the ecosystem for ReMe on a daily basis and at a predetermined time and exchange rate. The exchange rate will be a function of the number of ReMeLife Care Action Points in circulation and the number of ReMe held for conversion by the ReMeLife Treasury.

ReMe tokens are expressed using an ERC20 compliant smart contract hosted on the public Ethereum blockchain.

However, there are two major constraints with Ethereum: transaction throughput and transactional cost.

Modelling shows that the ReMeLife ecosystem is likely to grow to around a million active members within the first year of deployment with growth to several million active members within 2 years.

For each million active members there will be on average 5 million transactions per day.

This is equivalent to about 60 transactions per second (tps). The busy period is expected to see 5 times average transaction rates, this implies the need to provide the ability to process up to 300 tps for every million active ReMeLife members.

The current Ethereum network can process transactions at the rate of less than 20 tps. Furthermore, at the time of writing, the average cost of a transaction performed on the Ethereum main network is about US$3.50, this implies that even were it to be technically possible, running the ReMeLife ecosystem on Ethereum would cost over $17 million per day per million active users, which is clearly impractical.

To overcome these two problems, the blockchain architecture we propose allows for ReMe, and ReMeLife Care Action Points transactions that occur within the ReMeLife system to be processed on one or more side blockchains to the main Ethereum blockchain.

Only transactions that involve transferring ReMe to external parties will need to be processed on the main Ethereum blockchain.

The side chains, termed the ReMeChain, will be one or more permissioned semi public blockchains that will use the Ethereum protocol. They will not use proof of work mining but instead will use the Clique1 PoA consensus protocol.

To avoid the risk of spam transactions, transaction gas charges will be applied and will be denominated and paid in ReMe.

ReMe will be represented on the ReMeChain using the ReMeChain’s native Eth. This is created in the genesis block and will be allocated to a Treasury escrow account.

Tests show that permissioned Ethereum based blockchains can reliably process thousands of transactions per second. At this stage, a single side chain is envisioned but the design will allow for further side chains to be created should the need arise.

Smart contracts hosted on the ReMeChain will be used to manage the rate of exchange offered for ReMeLife Care Action Points (RCP) to ReMe conversions. These smart contracts will be invoked on a frequent periodic basis. A nominated lead node will be responsible for performing this operation.

The frequency of the ReMeLife Care Action Points to ReMe conversion will be determined by a defined time interval passing, e.g 24 hours, between each invocation.

The ReMeLife scheme provides a hosted, non-custodial, wallet service to allow holders of ReMeLife Care Action Points and ReMe to access and transact their tokens that are held on the side chains and any that have been transferred to the main Ethereum network.

It is expected that one side chain will need to be created for every several million active members. Transfers of ReMeLife Care Action Points and ReMe between side chains will not be necessary. The ReMeLife wallet will access account balances on all the side chains and will show the wallet user a consolidated view of their account balances as held on the various side chains together with separate balances for ReMe held on the Ethereum main network.

Transferring tokens from the ReMeLife network to the main Ethereum network will require the payment of Ethereum network gas charges. These charges will be paid by the Treasury’s smart contract controlled escrow account that holds the side chain’s aggregated ReMe funds on the main Ethereum network. The Treasury will recoup these charges from the account holder by charging the account holder a small amount ReMe for the transaction.

The ReMeChain will be based on the Ethereum Clique Proof of Authority (PoA) protocol and will be implemented using Go Ethereum, Geth, clients.

The Clique PoA protocol approves blocks using designated nodes called “Signers”. These nodes are identified by a secret private key stored in them. Special attention will be paid to securing these signing nodes.

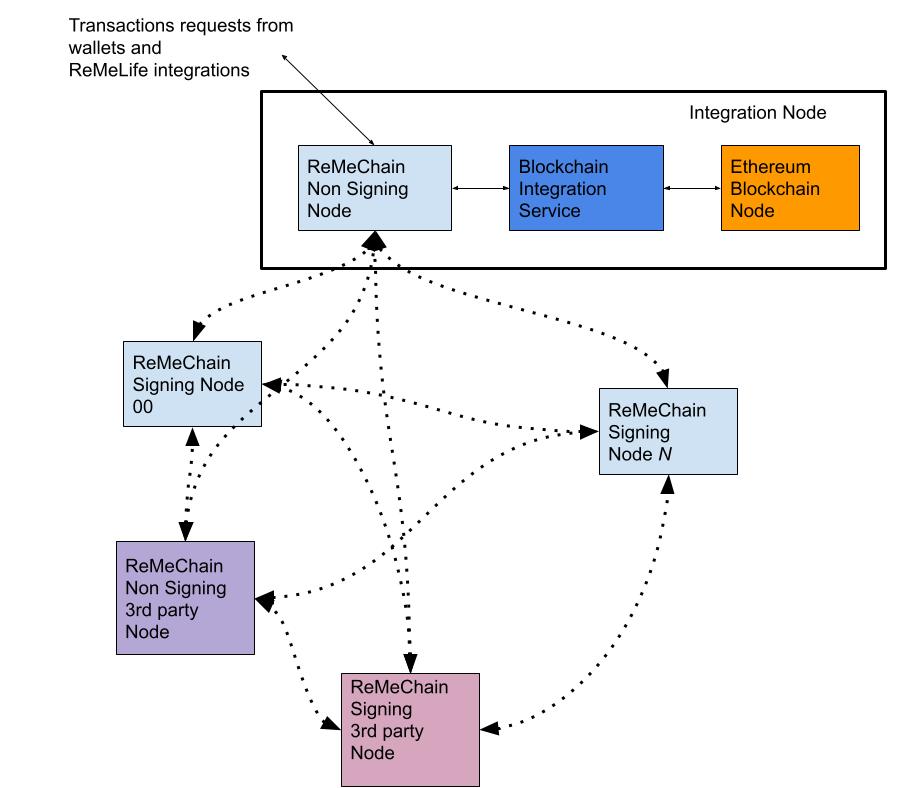

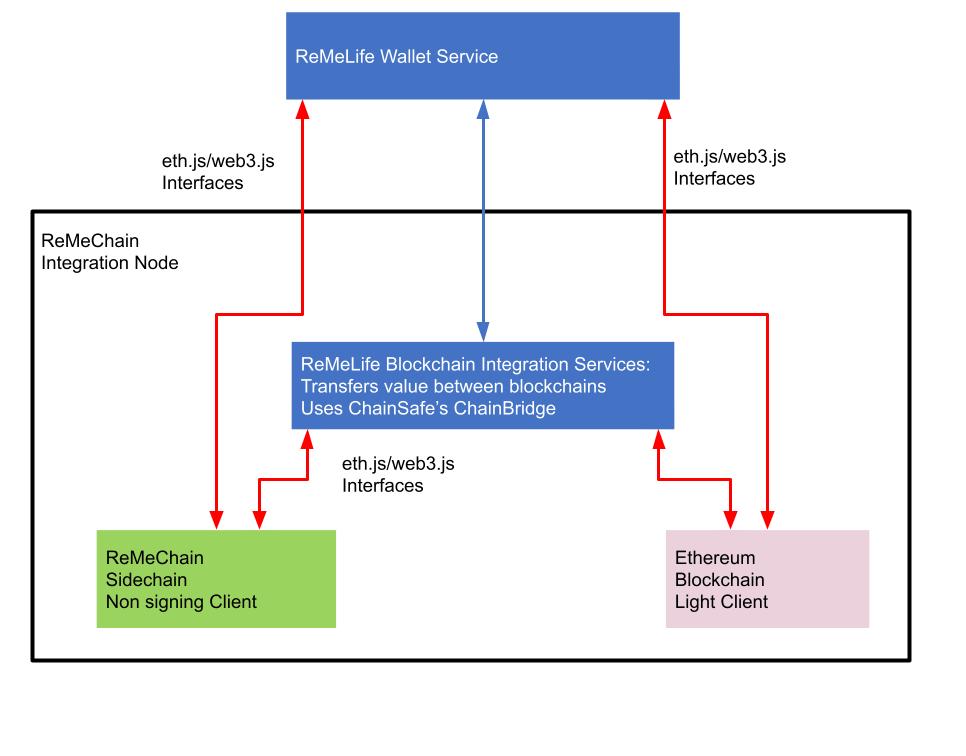

For security, transactional traffic will be routed through non signing nodes, integration nodes, as illustrated in the following diagram. In addition, it is envisaged that partners and other third parties may run both signing and non-signing nodes on the ReMeChain.

There may be a number of these nodes distributed across several data centres.

In addition to ReMeLife integration blockchain nodes there will be a number of signing nodes distributed across several data centres. The Clique consensus requires a quorate majority of 66% + 1 of the signing nodes to approve transactions and blocks. A network with 10 nodes needs at least 7 nodes to approve all transactions and blocks.

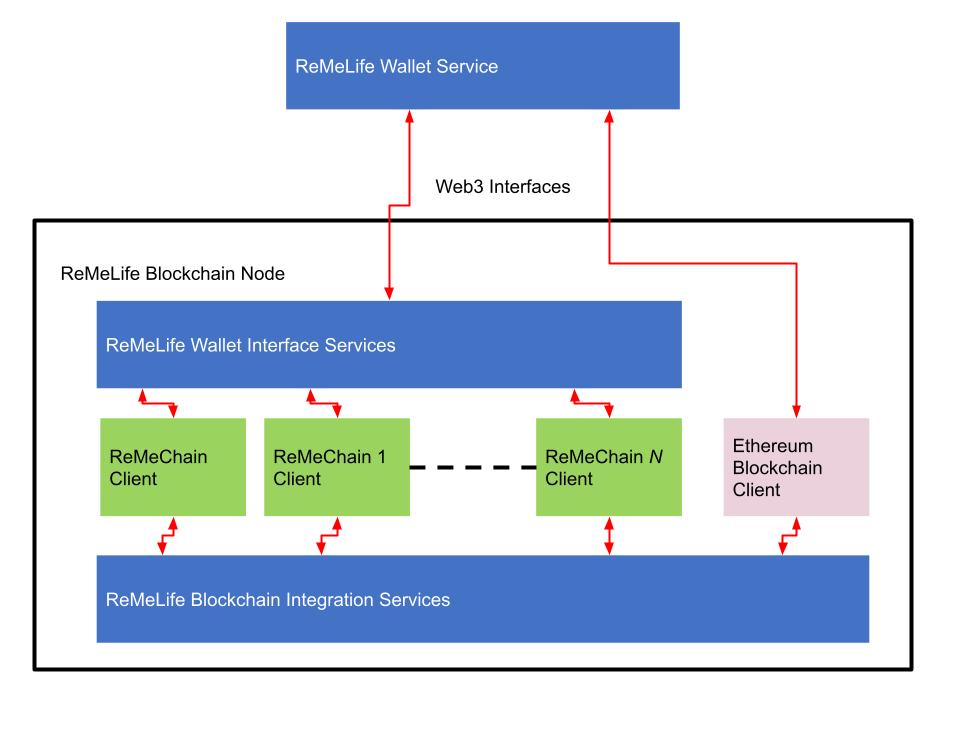

The following diagram illustrates the main components of a ReMeLife integration blockchain node. This diagram reflects the fact that in the early stages of the project only one ReMeChain sidechain will be required.

The main components of the single chain integration node are:

- The ReMeChain non signing client node

- The Ethereum client node

- The integration service, possibly based on ChainSafe/ChainBridge2

As the traffic volumes increase it may be necessary to increase the number of ReMeChains.

This change is reflected in this diagram.

A ReMeLife Blockchain Integration Node will be made up of a number of individual servers, each one running a main component of the node.

The main components of the node are:

- The Geth Ethereum clients. Each blockchain has its own client running within the node, one each for each sidechain and one for the main Ethereum network.

- The Geth client's interface with the ReMeLife Blockchain Integration Service using the Web3 protocol. The integration service managers the interactions between the sidechains and the main Ethereum network.

- The sidechain clients also interact with the ReMeLife Wallet Interface Service (WIS). This service hides the complexity of multiple side chains from the wallets and presents the wallet with a standard Web3 interface. The WIS provides a consolidated view of an account’s balances that can be spread across a number of sidechains.

It is envisaged that other voluntary and not for profit organisations will want to host their own token based schemes using the ReMeChain infrastructure.

A variety of blockchain based marketing focused models are available for deployment to service the needs of partners and affiliates, which optimise the Membership loyalty relationship, to the benefit of all parties, and without exploitation of the data